Gab@StFerdinandIII - https://unstabbinated.substack.com/

Plenty of cults exist - every cult has its 'religious dogma', its idols, its 'prophets', its 'science', its 'proof' and its intolerant liturgy of demands. Cults everywhere: Corona, 'The Science' or Scientism, Islam, the State, the cult of Gender Fascism, Marxism, Darwin and Evolution, Globaloneywarming, Changing Climate, Abortion...

Tempus Fugit Memento Mori - Time Flies Remember Death

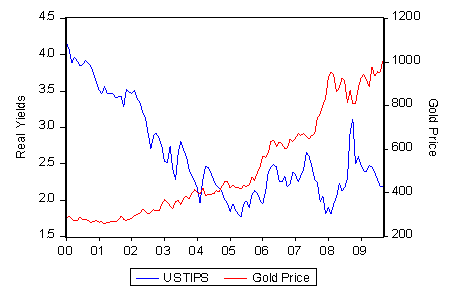

With gold approaching $1200 per oz., up from $250 a mere 5 years ago, what is that telling us about the state of geo-political and economic affairs ? Is it just another commodity-bubble market ? Or maybe just more nasty speculators daring to make a profit ? Perhaps it is the insidiously corrupt Wall Street and Goldman Sachs – the US Government's financial slave – manipulating the yellow currency for its own cryptic means ? It is all of these things and yet more. If gold prices move from $1200 to $1500 we will have two indisputable facts to reckon with: 1) Future high US based inflation and 2) An economic Depression.

An iron law of investing is to do the opposite of what 'media experts' tell you. By the time the grinning teeth with the makeup and hair 'advise' you on something it is usually too late, too wrong, or too corrupt to consider. Witness their expert advice telling the hoi-polloi to buy condos in Miami or jet-set to Dubai to behold a bankrupted state's narcissism and real estate bubble. So what are most 'savvy' 'experts' telling you ? The usual. They state that gold is over bought, the rally in the precious metal is a bubble; and that the US dollar will rebound because the US economy is going to have a V shaped recovery – with the V looking perhaps more like an U. US GDP and employment growth [both stats are frauds and at the mercy of government manipulation], will be raging in 2010 and beyond. Happy days are soon here again.

So the grinning idiots who did nothing to predict the latest economic meltdown tell us. So who do you believe, government shills or your own lying eyes ?

Gold's meteoric rise in the past 5 years has been one of the great commodity gains in history. It is thus a long term trend – not a bubble. Gold might be telling us something different from the 'experts' and that inference is most likely, that the current economic re-ordering is going to be a long lasting Great Recession – or worse.

Recognize this: the 'experts' and mainstream economists are Neo-Keynesians. They believe that big government, big spending, big programs and mass socialization can 'save' the economy – from government created catastrophes. Neo-Keynesianism based on the incorrect, improbable and rather occult theories of 'aggregate demand' and managing the 'demand gap', as evinced by the effete, homosexual Keynes during the 20s and 30s, is utter bunk. Keynesianism is garbage – a theory looking for real world relevancy. Yet it is the policy of choice for Statists, giving them a panache of intellectual gravitas [but Keynes talked with a lisp and wore tweed jackets!], as well as a quack-science [akin to Marxism], justifying the expansion of state intervention.

In the real world we all know that government's create cycles of booms and busts – they don't resolve them. The more intrusive the state the worse the result – as the Great Depression and this current crisis, which is no where near ending, both demonstrate. The more neo-Keynesian the state, the more likely that monetary and central bank policy is completely politicized [like the US Federal Reserve], and the more obvious it the corruption between the state and the large financial houses [like the Washington-Wall Street nexus].

The test for Gold will come in the first half of 2010. If the price of this metal crashes through the important barrier of $1500 the following will be true:

-Real US unemployment [not the government figures] will be 25-30%.

-Real US GDP normalizing for real inflation [not the government figures] will be in the process of contracting upwards to 30% from its $14 Trillion level.

-Real US per capita income [not the government figure] will fall to $25.000 per capita [or the level of Israel].

-Real inflation measures [not the government figures] will be 8% or greater.

-Stock markets will eventually realign with reality and proceed downwards to match their previous 2009 lows.

If gold goes through the $1500 barrier it will be telling us quite simply that the US and the industrialized world will have high inflation; low to zero real economic growth; and the specter of state bankruptcy. The US is technically bankrupt already. There is no disputing this fact. This is one reason why gold keeps rising. The US state cannot afford its debts, it future liabilities and its obligations especially as interest rates will need to rise to fend off very strong inflationary pressures. The US dollar is doomed, and gold will take its place rightly or wrongly as the world's reserve and standard currency.

Gold is telling you something. It might pay to listen. It might also pay to ignore the talking circuses in the media which did not predict this latest catastrophe – a regressive process, which by the way is not over, but just starting.