Gab@StFerdinandIII - https://unstabbinated.substack.com/

Plenty of cults exist - every cult has its 'religious dogma', its idols, its 'prophets', its 'science', its 'proof' and its intolerant liturgy of demands. Cults everywhere: Corona, 'The Science' or Scientism, Islam, the State, the cult of Gender Fascism, Marxism, Darwin and Evolution, Globaloneywarming, Changing Climate, Abortion...

Tempus Fugit Memento Mori - Time Flies Remember Death

Going into debt has consequences. It is not difficult to see how or why we are in a deep recession. Government policies, preferences, subsidies, monetary policy and corruption has led us here. Government is not the only entity to blame. But government actions will distort and impel private actions. The current crisis is one of debt and of basing debt instruments upon the rather insane assumption that land values only go up. The sad reality is that business and government debt, along with land prices are still at unsustainable levels and need a further correction.

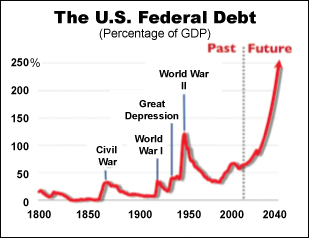

Governmental debt is enormous and growing. Consider the following:

-the EU has a future debt liability of close to $100 Trillion or more than 6 times the current GDP

-the USA has a future debt liability of at least $60 Trillion or more than 4 times the current GDP

-the US is going to run deficits between $1.5 Trillion and $ 2 Trillion for the next 2 years

-Japan's current debt is 120% of GDP meaning that effectively it cannot access more debt and is technically verging on insolvency.

The American $60 Trillion of future debt obligations include paying pensions, health care, and social service payments to retired government workers; and anyone over 65. At some point in the next 20 to 30 years, there will not be any money left in government accounts to pay off this huge liability. Only three things can then happen; taxes are increased markedly; more debt is assumed to pay the liability; or the government does not meet its obligations and defaults on those payments. There is no economic means to increase net revenues to pay these debts off, so those three options are all that we or the next generation will have to consider.

And this scenario is true throughout the Western world. We are technically bankrupt. Debt has crushed our culture, our sense of responsibility; our politics and which led to widespread corruption in both the corporate world including banking and within government and politics. The state of affairs is not only rotten, it is rotted.

For 60 years the modern Western nation has erected the mommy-state – the all knowing, all loving, benign and caring communal nirvana, promised over two thousand years by religious and secular mystics alike. This compassionate program grew of out two World Wars when the 'common man' initiated a revolution in expectations and in fairness in both economics and politics. Now carried to extremes with no signs of it being stopped the growing paternalism of the state has led to the inevitable – bankruptcy on many levels.

The current crisis was caused by many factors chief among them:

-politicians pushing home ownership as part of the modern 'dream'

-subsidies to home buyers and home builders

-kickbacks by banks to their regulators to ignore bad banking and lending practices

-a cultural addiction to consumerism, fueled in part by government's desire to increase taxes

-a cultural shift from individual responsibility to social or national responsibilities

-a disregard everywhere for debt and what debt will do to a person, city, region, state or company, if debt levels are in excess of real asset values

Why would even an optimist conclude that things must get worse ? Consider the following:

-Every government in the Western world is increasing spending on government programs [properly termed welfare but called a 'stimulus'] incurring trillions more in deficits and debt.

-Every state in the Western world is printing money and has zero or negative real interest rates [two of the factors which created the current recession].

-Every state wants more regulation, more government oversight and more government ownership of the economy – actions which will retard economic growth and destroy private capital.

-Personal incomes are falling – along with employment levels. As incomes fall, asset values must fall as well. People for example in 2010 will not be able to afford to buy any large asset including a car or a house, at 2009 levels. We will have short term deflation; followed by a longer term inflation [due to the trillions of dollars being printed and the future devaluation of the currency that ensures.]

-Corporate earnings are off by 50% in most industries. This will mean a real decline in wages paid, and more layoffs.

-International trade is falling. According to a well respected analyst, "After growing in every quarter during the last three years, real goods exports fell 34.9% at an annual rate, the worst performance in more than three decades." (www.dismal.com) As world GDP falls so will trade decline.

And perhaps worse of all:

-European banks might need anywhere from 5-$25 Trillion [or 1.5 times the size of the EU economy] to survive. If this is true it will destroy the European economy: "Part of the problem is that European banks were far more highly leveraged than US banks. Some banks were reportedly leveraged 50:1. And they lent money to Eastern European projects and businesses which are now facing severe financial strain and plummeting local currencies.”

-Nouriel Roubini (www.RGEmonitor.com and professor at NYU) estimates that US banks will announce future losses of $1.7-1.8 trillion out of a total of about $3 trillion in total financial system losses. His base assumptions are not all that bearish, given what we know: a 5% GDP contraction and 9% unemployment, with housing prices down another 20%. All those estimates are quite plausible.

It is not fun being negative. Neither is it right to be pollyannish. Thanks to government distortions there will most likely be a financial and sovereign debt default recession in our near to mid-term future . Real unemployment rates are already at 15% in North America. The US has lost 2 million jobs in the past year and will lose another 2 million this year. Europe is faring worse. The consequences of too much debt and over leveraging, combined with government corruption and political distortions are enormous.

We are only now coming to the realization what 60 years of government growth, including an addiction to drive up land values and force citizens to consume, really means. What remains to be seen is if we have the intelligence to understand why it all happened, and what we should not do going forward. Somehow with the ever-growing mommy state, Obama, and the radical leftists assuming even more power, that is highly doubtful.