Thursday, January 14, 2010

Government created stock fraud.

Know when to hold them. Know when to fold them. And know when to run.

by StFerdIII

Stock markets generate the best returns. There is no disputing this fact. But the caveat is, you have to know what you are doing and manage your own money. If you listen to 'experts', 'brokers' and bankers you will lose your money. None of these people – none – predicted the current economic meltdown. None of them – none – have a clue about what is going to happen in the near term. As a person who sold out before the collapse in the fall of 2008; shorted the market until February 2009; and then bought into banks and technology in February, March and April, I feel far more qualified than the professionals in analyzing macro-market trends. And the omens look ugly.

It is not invigorating to be a pessimist. Optimism is more suited to moving ahead in life. But reality is not a Prophet Obamed speech full of lies and vapidity. Nor is it an Oprah and Friends scam where the charlatans sell you quack psychology and Dr. Phil's pablum snake oil – all to make you the superstar that you should be. If you sold out in August 2008 and than shorted the market for a while, you would have made a huge return. But who told you to do that ? CNBC ? Cramer ? Kudlow ? The NY Times ? Barrons ? No one did. The good times, based on a historically unparalleled expansion in credit, debt and leverage derivatives of every variety would last forever. So most of the mainstream, Neo-Keynesian, and straight laced monetarists told you.

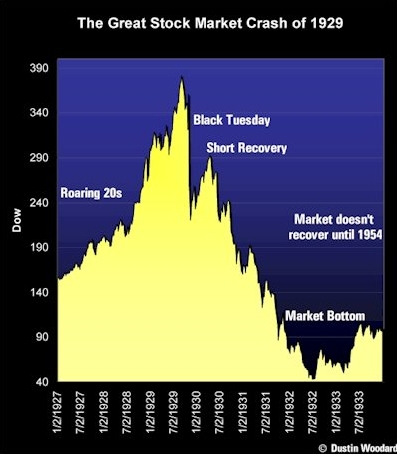

The market was overbought at its height of Dow 14000. Price earnings were in the 20-21 range – 30% higher than they should have been. The leverage fiasco had existed since 2002 for anyone willing to see reality. Sub-prime loans; speculation; negative interest rates; M3 money supply expansion; and bank leverage ratios of some 30-95: 1 ! [Fred and Fan were levered at close to 100 to 1]. All of this liquidity and debt leveraging made a stock market collapse inevitable. The same scenario had happened of course, during the 1920s. Leverage cycles create asset bubbles. As the bubble unfolds greed and speculation rush in leading to leveraged risk-taking and bad capital allocation decisions; which inevitably bids up prices to some level that becomes unsustainable. Anyone looking at real estate from 2000 to 2007 and who noticed that the 50 year average return of 3-4% before inflation was now suddenly 10% or better, knew it was a bubble.

But few in the mainstream media bothered to tell you. They were beating on the drums that you had to buy condos in Miami, Dubai, and trot off to Arizona or Las Vegas and buy land. If not you were not cool, hip and in tune with how to get wealthy in America.

So now the story is what ? The stock market has 'recovered' and this year will see returns of 10%. GDP growth [a fraudulent number], will be 4% this year. Unemployment thanks to the Black Jesus' insidious 'stimulus' of $5 million per new job [all 10.000 of them perhaps], will decline. The media will hail the Obamed's as geniuses. Neo-Keynesians will wail that the occult theories of the homosexual Keynes are once again the only possible policy reaction when an economy craters, thanks to government incompetence, fiscal irresponsibility, debt accumulation, state program bankruptcy [see Medicaid and Medicare]; and housing finance manipulation by politicians and state departments like the HUD, CRA and Fran and Freddie. Yep. Government 'solving' the crisis which government created. The talk of madmen.

These are the reasons – all of them ephemeral – as to why the stock market is up this year:

-

Funds are chasing returns;

-

Interest rates are at zero so the only place to make money is in equities

-

No one with an ounce of rationality wants to own US Treasury Debt since America is going bankrupt

-

The Fed Reserve is liquidating Wall Street allowing investment banks to use Government printed paper to buy equities to hold up the markets.

The whole market is held up by Hiero-like inventions of sophistry, manipulation and visual distortions. Much like a statue or a machine from the first century AD's master mechanic and inventor, the current market is being held up in front of its audience by devices, wires and magnets that are impossible for the average person to see. Take away these false supports and the statues and the machines – along with this market – comes crashing down.

Interest rates have to go up.

The money in this long term bear market rally has been made.

The US dollar is doomed and funds are turning to cash, gold, silver and commodities.

Economic growth is a lie – GDP which rewards spending but does not take into account debt – has no real relevance for how the real world economy is functioning. And that economy is still in a lot of trouble [you don't blow through a 30 year created bubble in 1-2 years and recover all those 'bubble' jobs].

One economist/broker blogger wrote an article on why he thought 2010 would be a great year for stocks. The usual forest for the tree detail premised on some arcane and abstract theory. Much to his amazement he received the following, caustic and entirely valid reply about the fraudulent nature of the current stock rally:

“The comment I received is worth discussing since it reflects a belief that is widely held today concerning the financial markets. He writes, “The stock market is artificially propped up through government purchases of Dow stocks with tax money deposited in broker accounts at such money centers as Goldman Sachs and JPMorgan Chase, among others. They can levitate the markets indefinitely with Fed Reserve account funds. The U.S. stock market is a fraud. Surely you must understand that.” http://www.financialsense.com/editorials/droke/2010/0111.html

The sceptic is entirely right. Golden Slacks and friends are trading on the Fed Reserve trillions pushing up stock prices, and turning profits on trading. The stock market is thus not an indicator of the overall economy, but simply an indicator of the nexus of corruption between Wall Street and Washington. The market is a scam. At some point the real world will have to physically pick up Wall Street and lift it out of New York and put it down near Capitol Hill in Washington. That is where the rigged and manipulated fraud belongs.