Tuesday, October 6, 2009

The Empire's decline is forecasted in its dollar.

You can't debase your medium of exchange.

by StFerdIII

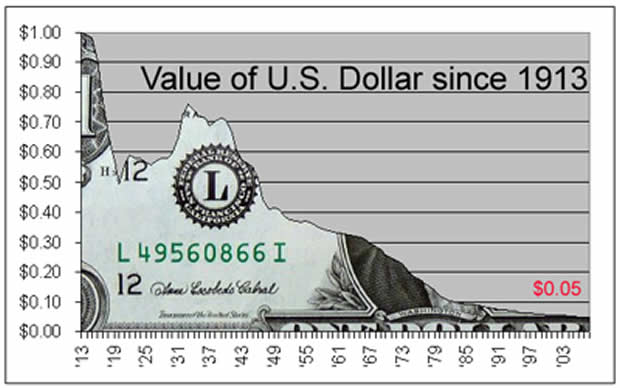

One of the great consequences of socialism in America – a 40 year process which is seeing its apogee in the Presidency of his divine Holiness the Prophet Hussein Obama – is the destruction of its imperial ties premised around the dollar. You cannot run an empire – even a loose one – on a declining value of exchange. No empire in history has survived the deflation of its money. The US will not be any different if it does not correct its fiscal and monetary policies in the near term.

The dollar's decline heralds a mighty future dislocation in geo-political and economic affairs. The empire will unravel unless the dollar deflation is stopped. It will also act as a tax on US economic activity, further weakening the American economy and casting more doubt on its ability to fund its military and project adequate military and economic power. Its decline is spectacular. As I wrote on March 06 2008:

“Over the past 30 years the dollar weighted index has fallen from 100 in 1974, to 60 in 2008. This is a dramatic 40 % drop in one generation. In 2001 the dollar index was at 110. In the past 5 years the dollar has dropped close to 40% and has fallen by 5% in the past month alone. This is simply an unsustainable dollar devaluation crisis. If not arrested it will herald the end of American hegemony and presages a huge inflationary run up.

The greatest threat to wealth is inflation. Inflation is a tax on consumers and wealth. As purchasing power declines wealth in all dollar denominated assets also decline. Incomes typically can't keep up with 4% plus inflation – at least not in the short term – so real wages fall. As wages fall in the short term the consumer part of the economy contracts.” http://craigread.com/displayArticle.aspx?contentID=799&subgroupID=12

'Seigniorage' is an important concept in imperial systems. It is the profit that the Americans make through the difference in the cost of printing US dollars and their actual face value. The profit is significant running into the tens of billions per annum. Part of this profit-taking can be used to fund profligate monetary policy, or a lack of domestic savings as reflected in a negative trade balance.

It is no wonder that the UN, which wants a One-World government premised on a world currency and self-interested regional powers such as the EU bloc; Russia, China, India and Brazil, all desire a new reserve system. For the regional powers the ending of the US as the world reserve currency would give the regional bloc's main member state[s] far more power and leverage to act as that Bloc's currency unit of choice. China would thus have a Chinese-Yuan sphere of influence, Russia could propose that the Rouble replace the Dollar in the Former Soviet Union; Brazil might extend the Real as the reserve unit throughout Latin America and even the UN might be able to align African, Muslim and Asian states behind some new 'One-World' currency to replace the US dollar. Europeans would see bountiful opportunities to thwart such regional aspirations and propose that the Euro replace the US dollar in key Latin American and Asian states.

In any event by ending US hegemony in monetary affairs, regional powers and the UN would be able to erect a new international system; often-times aligned against US interests, and a geo-political reorientation towards either regionalism or as the UN would desire; massive transnationalism centered around the UN General Assembly. This is exactly what is now being proposed:

"The United Nations called on Tuesday [Oct 6 2009], for a new global reserve currency to end dollar supremacy which has allowed the United States the "privilege" of building a huge trade deficit.

"Important progress in managing imbalances can be made by reducing the reserve currency country's 'privilege' to run external deficits in order to provide international liquidity," UN undersecretary-general for economic and social affairs, Sha Zukang, said.

Speaking at the annual meetings of the International Monetary Fund and World Bank in Istanbul, he said: "It is timely to emphasise that such a system also creates a more equitable method of sharing the seigniorage derived from providing global liquidity."

He said: "Greater use of a truly global reserve currency, such as the IMFs special drawing rights (SDRs), enables the seigniorage gained to be deployed for development purposes," he said.

The SDRs are the asset used in IMF transactions and are based on a basket of four currencies -- the dollar, euro, yen and pound -- which is calculated daily.

China had called in March for a new dominant world reserve currency instead of the dollar, in a system within the framework of the Washington-based IMF"

http://www.breitbart.com/article.php?id=CNG.e272eaa74dccc30f21c6ff7638b0f37b.461&show_article=1

UN haters such as myself might ridicule the aspiration. But it does make sense. The Imperial dollar will suffer from massive future inflation. The US economy will suffer. And the projection capability of America in international affairs will be curtailed. As my note from March 08 stated:

“The US dollar's 30 year decline once again proves the folly of governmental and political posturing. Once the US dollar loses its status as the world's reserve currency, it will soon relinquish its imperial dominance. This is not a positive for anyone inside the US imperial system. Empires bring peace, prosperity and wealth creation. International economic chaos does not.”

A world run on regional blocs without a true international hegemon will not be stable. A world run with competing reserve currencies will not be a positive. The Americans of course, have only themselves to blame. It remains to be seen if post-Obama they can save their country and their empire, from the ravages of socialism.