Wednesday, August 17, 2011

Gold will replace the fiat currency scam.

Paper is no replacement for reality.

by StFerdIII

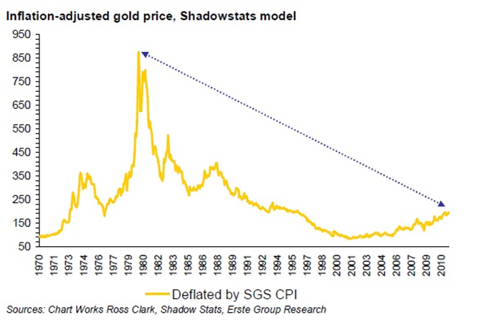

The Gold Standard in and of itself is not a 'cure' for economic malaise, delirious self-deluding fiscal whoring [all for the children's future], nor for sound money [see here]. But it can surely help. Gold will continue to rise and probably treble from its current level in the near term. The fiat currency regime, in place since 1971 when Nixon ended the Gold Standard and embarked the West upon a regime of printed paper with no metallic support, has allowed the brainy people including politicians, politically-dependent central banks, the state bureaucracy and the compassionate class; not to mention the 'great men' such as the Obama, unfettered opportunity to print, spend and deface the economic landscape, while trammelling upon the backs of the 'peasant mass', like a pack of baboons as real currency values have declined by 95% in the past 50 years. The fiat scam at some point however, will soon be over. Gold is still cheap – buy now, buy often:

Paper currency regimes have never lasted in economic history. Even metallic monetary systems can implode from debasement and inflation. One of the prime reasons that Rome eventually failed was in part due to inflation and monetary decline. No one had confidence in the silver denarious or the Roman bronze and gold coins. The monetary stock was constantly plundered and devalued. Civil wars – the fighting over a stagnating economy and set of land-based assets was almost inevitable. When you remove confidence from the economic system, chaos is usually the result.

The current currency regime makes little sense. The US has $100 Trillion in real debts built upon 10 tonnes of gold stock and a fast depreciating paper currency. Europe is technically bankrupt with fewer gold reserves than the US and calls for the issuance of more debt or EuroBonds to pay off existing debts. This illogical approach is applauded by the clever class. The Eurozone area is an unnatural currency domain and will die a shuddering death. When is the only question.

A good article has quoted three realists when surveying the fiat scam and the rise of King gold:

-The President of the World Bank, Robert Zoellick, wrote in the Financial Times (‘The G20 must look beyond Bretton Woods II’ - November, 2010) that a new monetary system involving a basket of currencies “should also consider employing gold as an international reference point of market expectations about inflation, deflation and future currency values.”

-Jack Farchy wrote in the Financial Times, “The return of gold as a prominent financial asset is without doubt the most important development in the bullion market today.”

-Ex Economics Editor of The Telegraph, Edmund Conway wrote over the weekend how “we've had the financial crisis that usually marks the beginning of the end of established monetary systems. And now we are seeing the debasement.” and “These bouts of debasement typically end in disaster, as faith is lost in the currency, inflation shoots through the roof and the economy collapses, after which politicians introduce a new, more credible system.”

Happy Days are not here again. Not yet and not for a long time. The smart people will continue to spend, print, demonize markets, blame rating agencies, castigate 'greed', and still endeavour to socialize all aspects of life. It will fail. It always does. One of the first items to collapse in an empire is the currency. Given the current set of policies and politicians in place, this fact will not be overturned in the near term. The fun is just starting.