Tuesday, March 12, 2013

Governments just love the real estate bubble [er rational price increase...]

Tax and spend.

by StFerdIIIBubbles do burst.

Government's official statistics': no inflation, 7-8 % unemployment, expanding GDP of 1-2%.

Back in the real world: Inflation is 3-5%; employment is falling towards 62% and GDP is a spending algorithm with little inherent value or honesty. Governments create nothing but bureaucracies, taxes and debt [okay, public schools, sidewalks, libraries and globaloneywarming can be added].

In the world of statist theology: Keynesian theology is factual, Globaloneywarming is science, more taxes is moral, deficits don't matter, high debt load is healthy.

Back in the real world: Keynesian theology is an insipid mysticism, Globaloneywarming is a criminal scam; more taxes destroys jobs and wealth; and high debt eventually leads to some form of insolvency.

Real Estate is another government directed, funded, supported and elaborate hoax. Historically house prices were 3-4x average annual income. Now in major urban centres they run from 8-15 x average incomes. A bubble perchance ? Or just 'market forces' [directly benignly by the state] finding their 'right' price levels ? The latest great recession was caused of course by government interfering in the housing market. Today house slaves are the norm, and any market that sees a 3 fold increase in costs is likely in the midst of a roaring epidemic of madness.

House slaves:

If you add up all the carrying costs of real estate you need to make 5% a year price gain, just to break even. Historically real estate prices rise by about 3-4% annually – except when there are bubbles.

Inflation is at least 3% a year contrary to government propaganda [see your own budget].

Interest on your loan is .25-.50 % a year.

Taxes are 1 % on average of the house's value.

Insurance, upgrades and maintenance are .50 % on average for most households.

Total: 4.75-5 %

Add in a major upgrade or a large renovation and the 5% rises towards 10% pretty quickly.

If real estate does not increase in value by 5% or more per-annum, you lose money. Period. But who thinks in such terms ? Very few.

Governments love real estate for obvious reasons. According to the media and government, real estate 'stimulates' the economy by soaking up excess pools of labour both legal and illegal; it is taxed, it is regulated and fee's are applied to all developments, and it may provide some social stability [though this is highly disputatious].

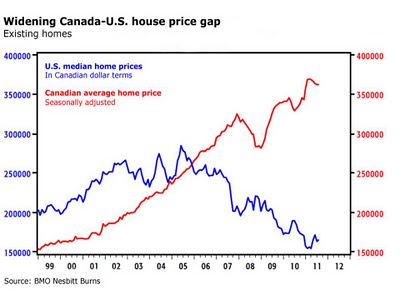

No bubble here ?

Governments are essentially bankrupt if you add in unfunded liabilities. Real debt to GDP is 5-8 times. No state in history has survived a real debt level of 2 x economic size. So it goes with households. Paying $150.000 in interest on 'your' home [the banks own it], and then dismissing all carrying costs and inflation in your calculation of your real estate 'return', after 25 years, is about as scientific as the cult of warming which screams that a trace chemical 95% emitted by Gaia, causes the warming which causes the snow and ice records one reads about every winter which occur around the globe. It is bunk. Real estate is not a rationally relevant investment. It is emotional. Much like the stock market at times.