Wednesday, April 17, 2013

Buy Gold. Ignore the 'Experts'.

Have some Gold coins on hand.

by StFerdIIIWhen the 'experts' say Gold is a bad investment the opposite must be true. The case to buy Gold is obvious. Those who chatter that Gold is worthless; not money; a bad investment [unlike say your house which after all carrying costs provides a negative return]; or 'irrelevant' since inflation according to 'models' is zero; ignore reality. These 'experts' refuse to acknowledge general fiscal insolvency, the endless printing of money, real-world inflation of 5% [not 0 as the 'models' say], and the looming destruction of the modern political-economy thanks to rampant statism and governmental malfeasance.

The recent sell off in Gold comes down to 2 factors. First, margin calls on large investment funds who bought gold with loans and not cash mandated a sell-of. Second, some people who are very, very, very, late to the equities party [where were you in 2009?], are transferring gold holdings into cash to buy stocks [not a good idea].

In the long term, Gold is the only currency. Fiat currency systems untethered to a metal always fail, crash and generate economic chaos usually within 3 to 4 generations. Gold has been the single best performing asset net of real inflation [not central bank and 'official' gobbledygook] since 2000. In 2000 this 'bad investment' was $200 / oz. Today it is $1390 and will probably bottom out at $1100 or so. A cool 5-6 x increase in value. This is 'bad' ? Where will gold be in another 20 years - $3000 ? Will that also be considered a terrible investment, unlike say real estate where after interest costs, inflation, taxes, insurance, upgrades, maintenance, legal and transfer fees you lose money ?

The reason Gold spiked post 2000 is obvious. Serious long-term investors view the unfettered printing of money, and expansive state, as nothing less than the road to oblivion and bankruptcy. And in the long-term they are right. Nothing goes up forever. It is good news that Gold is finally pulling back. At some point near $1100 you buy back in.

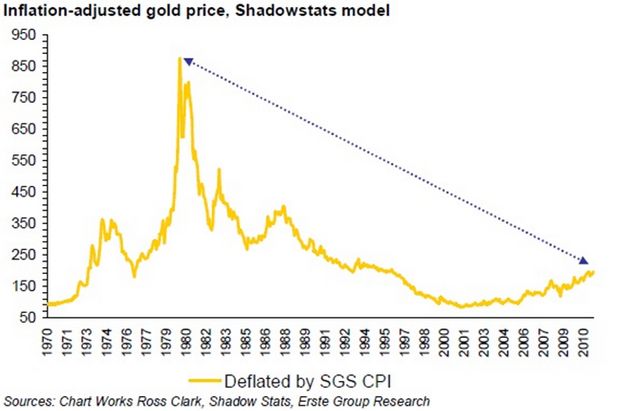

Look at it another way. If you bought Gold in 1980 what did you get ? A 300 % return is all. What a horrible investment especially given that after 1980 Gold supposedly went into 'terminal decline' losing almost half its value.

If you adjust Gold prices for inflation its real value is more apparent. 1980 was the peak price of inflation adjusted Gold. We are off that high. Since 2000 Gold has returned 400%. This means that as central banks print more paper, governments spend more money they don't have, inflation and tax rates [taxes are quite inflationary] continue to rise, people will eventually understand that the fiat currency system is broken. See the Euro for more information - an irrationality which will eventually implode. They will look to buy items they can chew and bite into, which have discernible and long lasting value [Gold, oil, commodities].

Gold is a long term investment of patience. There is a limited supply. It costs about $1000 an oz to pull Gold out of the ground and refine it. Over time as economic troubles revisit the modern political-economy, there will be an escalation in demand. The current economic fracas which began in 2008 is just the beginning of a 3 cycle, or a 3 phase insolvency process which is historically typical of systems which financially implode or go through a massive change in monetary and economic organization. Bankruptcy takes many forms including the inflationary. Time will reconfirm Gold as a very prudent investment. Every household should have Gold coins on hand. Just wait 10-20 years to see where the price will be.