Friday, May 2, 2008

Recession evidence is now finally here and it will be nasty.

Government incompetence and speculation has wrought unnecessary problems.

by StFerdIII

The data and reality arrived a while ago proving that we are in a mild, tepid and soon to be over recession. Markets are already correcting upwards in the expectation that flat or most likely negative economic growth will be stabilised and going positive by the mid summer. The crying cassandra's were proven right - but nearly to the fear-mongering extent that they want.

For many critics this recession is 5, 4, 2 years or 6 months too late. But better never than late in this case. The US is most likely in the middle of a 3-4 quarter recessionary period - and it is a mild one. A main question is what impact this will have on global markets, grade and economic growth. There will be an impact of course, but it remains open if the US recession will actually cause a world-wide recession.

The latest and most compelling evidence to date, is the fact that US non-farm payrolls fell 90.000 in the last 2 months. Now keep in mind that 12 million jobs were created over the past 5-6 years. So a minor jobs correction downwards is nothing to worry too much about. Yet this decline is an obvious indicator of financial and economic contraction. As one economist stated: 'This is the most compelling evidence to date that the economy is currently in what would qualify as a recession,' said David Resler, chief economist at Nomura Securities. Job losses and flat or negative economic growth is recessionary.

Recesion calls are now the norm across the financial-economic world. Lehman Brothers, Global Insight, Goldman Sachs, Morgan Stanley, UBS, The Northern Trust and Merrill Lynch have all claimed that we are currently in a recession. Given the escalation in commodity prices, the bank write-offs, the credit restrictions, and the lack of economic and job growth, these claims make eminent sense.

There are two definitions of a recession the traditional text book definition is that a recession is two consecutive quarters of GDP contraction. A less stringent definition is used by the private firm the US National Bureau of Economic Research, which defines a recession as 'a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.' There is no doubt that the NBER description has already occurred.

So the great question is what will the recession mean?

In the short term it will lead to falling real wages, rising inflation, a huge write off of wealth as stock, housing and financial assets all contract. Imports will slow, inflation will still rise as the US dollar continues to fall thanks to lower interest rates, and deficits – trade and budget – will increase leading to populist calls for more taxation and debt issuance. After the Democrats win control of Congress in november 2008 the increase in regulation and taxes will only extend the economic slowdown.

The US employment will likely fall from 72% to closer to 62%. By contrast the Canadian and European rates are currently 64% and 60% respectively, so the US has a much more engaged labor force than its economic competitors including the Asian nations. Along with productivity improvements this should help the US avoid a deep recession and keep the contractual pain bearable for the most part. However the most critical problem with the US economy is not overall job numbers, productivity, wage growth [gross 5% or more per annum]; but the financial system and the declining dollar which is fueling inflation – the greatest wealth destroyer known to man.

In order to arrest inflation and prop up the dollar the Americans should do the following; cut corporate taxes and income tax rates; reduce non-essential spending by 10%; ignore protectionist rhetoric; reduce the printing of money; and hold interest rates at 3% or higher.

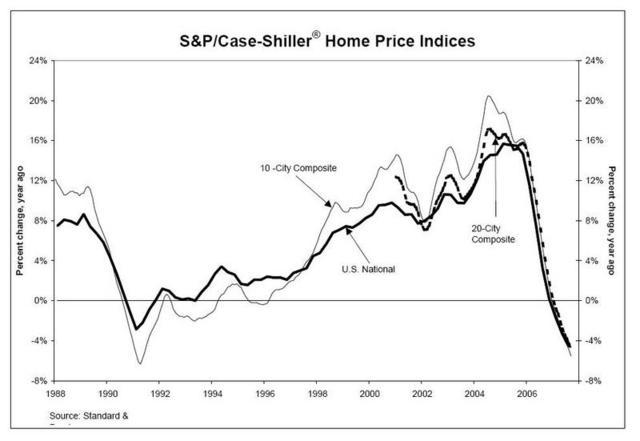

The US financial system which thrived for 10 years on speculative excess, cheap interest rates, low inflation and inflated profits, is in a bubble. What goes up must come down and the government can lessen but not prevent the associated fall out from the financial system's 10 year excess, built upon raging real estate speculation and bizarre credit instruments created on top of over-valued mortgages.

In the medium term the latent strengths of the US economy will mean a return to solid economic and job growth, income creation and productivity. But the government has no business to 'bail-out' individuals and banks who speculated and lost; or financial institutions who were so badly managed that they did not know the details of their own credit and loan instruments, but who elect to still pay their board members millions per year in salaries and bonuses for a job badly done.

Raising taxes, increasing welfare spend, sending cheques, and subsiding poor investment decisions and speculative greed, is not the role of government. Recessions for those who don't lose their jobs can be healthy periods of contraction, cleansing and eventual renewal. We don't need governments making it worse, or more profound than it already is.

But that is probably what the populists will do. All in the name of 'caring' and 'compassion'.