Tuesday, September 29, 2009

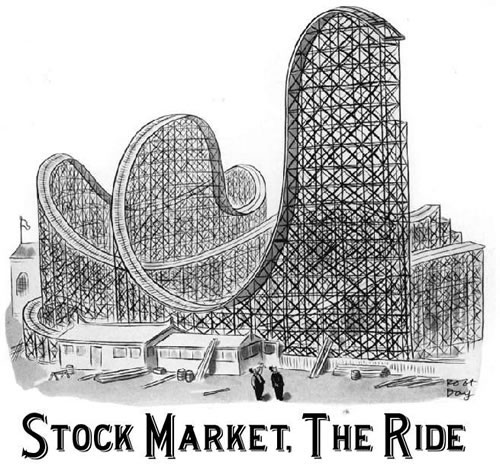

The current market run up is a fantasy-world.

Get into cash, and commodities.

by StFerdIII

You lose money when some or all of the following are apparent: the 'experts' agree; forecasts for rising and positive economic growth stretch on forever; geo-political events are ignored; and economic reality – especially fiscal reality - is ignored. Across the industrialized world we have: massive debts, guaranteed higher future inflation; and inevitably far higher future tax rates. Add to this the coming war in the Middle East and the wise man will very soon be into cash, and out of the markets. Life is not grey – it is usually pretty black and white. Such are facts.

Being negative is never fun. But neither is losing money. It is impossible that a 50% run up in major markets over 6 months will last. There has to be a sharp correction. But beyond this easily predictable occurrence lies some far deeper problems with the entire structure of our economy and the banking system. Add to this the inevitable Near East war, initiated by Iran's production of nuclear weapons and markets are destined to decline not just in the short term, but in the medium term as well.

America made a huge mistake electing the neo-phyte and ignoramus, the 'great' Prophet Obamed. One consequence of this silliness will be a nuclear armed Iran. When Iran owns a nuke the following will happen: the Persian Gulf will be sealed off; oil will rise to $300 or more a barrel; and Israel will be forced to launch attacks precipitating a wider conflict as Russia, China, the US and Europe by necessity become involved. As this conflict unfolds, markets will crater; business investment will stop; and we will have widespread economic stagnation. Even if there is no war, a nuclear armed Iran will control Iraq, the Persian Gulf and have a huge influence over Saudi Arabia. The consequence will in any event be far higher oil prices than even the $170 speculation spike of 2007.

And Iran is only one factor -albeit an important one. The US fiscal reality is almost entirely negative. Irregardless of pollyannish forecasts the following are simple facts about the US economic situation which mandates against a market rise in the near term:

-A doubling of US national debt.

-US governments will own 45% of GDP which is not healthy for markets or stocks.

-Taxes must go up to close national deficits.

-Inflation is forecasted by many to be at 5-8% at some point during the coming 2 years meaning that interest rates must go up to at least 8 %. As rates go from 0 to 8% debt failures will multiply across all sectors of the economy totalling trillions including yet again, another housing meltdown as many homeowners default on mortgage payments.

-The money supply has tripled in the past 2 years which has to ensure future inflation and the destruction of the US dollar and by extension the purchasing power and asset values of all Americans.

-GDP growth estimates of 3-4% in the coming 2 years are extraordinarily optimistic and sure to disappoint as reality gets in the way of fantasy. With more government, slower economic growth and capital lending restrictions it is hard to see why anyone would be so happy as to forecast GDP growth of 3% or better.

-Over-regulation of US business which always means a dramatic fall off in hiring and business investment.

Simply put in 2 years time the US will look a lot like Europe. And Europe is not a dynamic profit making entity. The EU is a political project whose design militates against market forces and the creation of wealth and profit. By following the EU the US will impoverish itself, deny the forces which create profits and assure that its currency will weaken further increasing inflation and further eroding confidence in US based assets.

The smart investor should soon be into cash. The only reasonable near term play is to buy oil and gold and wait for the inevitable doubling of these assets prices. It will happen. No one knows when but commodities due to a sinking dollar; high inflation; high future interest rates; are a surety. Reality is not grey – oftentimes it is pretty clear what is up and what is down. When all the 'experts' agree that the markets are going to go up; or that 'markets are priced very fairly'; or that 'things will be fine for the next year'; you know that the time to sell has come.

As Churchill said, “However beautiful the strategy, you should occasionally look at the results” As times change so should strategies and results.