Friday, January 11, 2013

Waiting for Phase 2 of the Insolvency/Debt crisis.

We are all bankrupt.

by StFerdIIIWhat can possibly go wrong from endless money printing, deficit spending, debt accumulation and zero-interest rates forever ? Party like its 1999.

Real US debt levels - $100 Trillion

Governments lie. It is their core business. The real US Debt levels is not the $16 Trillion the elite and media chatter about. It is over $100 Trillion if Generally Accepted Accounting Principles were used. $90 Trillion or so in unfunded liabilities is real debt, just as your future mortgage payment is part of your real debt. It is highly unlikely that you could ignore your mortgage when adding up your liabilities. Statists ignore future debt from unfunded systems crying that 'they are in the future', and according to these honest angels of government nothing except death and more government spending, is assured in the future.

“The actual liabilities of the federal government—including Social Security, Medicare, and federal employees' future retirement benefits—already exceed $86.8 trillion, or 550% of GDP. For the year ending Dec. 31, 2011, the annual accrued expense of Medicare and Social Security was $7 trillion. Nothing like that figure is used in calculating the deficit. In reality, the reported budget deficit is less than one-fifth of the more accurate figure.

Why haven't Americans heard about the titanic $86.8 trillion liability from these programs? One reason: The actual figures do not appear in black and white on any balance sheet. But it is possible to discover them. Included in the annual Medicare Trustees' report are separate actuarial estimates of the unfunded liability for Medicare Part A (the hospital portion), Part B (medical insurance) and Part D (prescription drug coverage).”

Real Euro zone [zeuro zone] debt levels – 400 to 500 % of Euro zone GDP

The [Z]Euro zone won't survive. At some point, the illogical nature of the 'currency union' will assert itself, as will real debt levels.

European nations are bankrupt. Debt to GDP including unfunded liabilities is 875% for Greece, 549% for France, 418% for Germany, 364% for Italy, and 244% for Spain.

For the EU overall it's 434%.

Europe is bankrupt. Germany is about as healthy as Greece. With a devalued DM named the Euro, it can export more to other countries, hiding its own insolvency.

Richard Nixon – another statist.

Richard Nixon another non-conservative, incompetent and liberal – will be known best for de-linking the U$ from gold and initiating the era of unlimited spending and socialization. Divorcing a currency from reality has allowed governments and politicians an unlimited supply of paper to buy votes and socialize society. Well done tricky Dicky. The other great monument of Nixon's disastrous reign is of course the EPA.

“In a single day in 1971, Nixon famously imposed wage and price controls in a naïve attempt to curb inflation, ended the U.S.’s last ties to the gold standard, effectively devalued the dollar, and imposed a 10 percent import surcharge. The list of agencies he created from scratch includes the EPA, the Council on Environmental Quality, and the Occupational Safety and Health Administration. He signed the command-and-control Clean Air Act into law and instituted racial quotas as federal policy. “Incredible but true,” Fortune magazine recalled upon Nixon’s death in 1994. “It was the Nixonites that gave us employment quotas.” As historian Joan Hoff has noted, “Not until the Nixon administration did ‘affirmative action’ begin to become synonymous with ‘civil rights.”

$4 Trillion in new US money since 2008 ?

Printing Trillions of US $? No problem. No inflation. Ever. It is just a big game. The $4 Trillion printed will be 'used up' by the banking system and economy – apparently using magic methods known only to Keynesian mystics. The real question is why don't they print a few Trillion more ?

This is equivalent to 20.4 million jobs per year paying $50,000 / year.

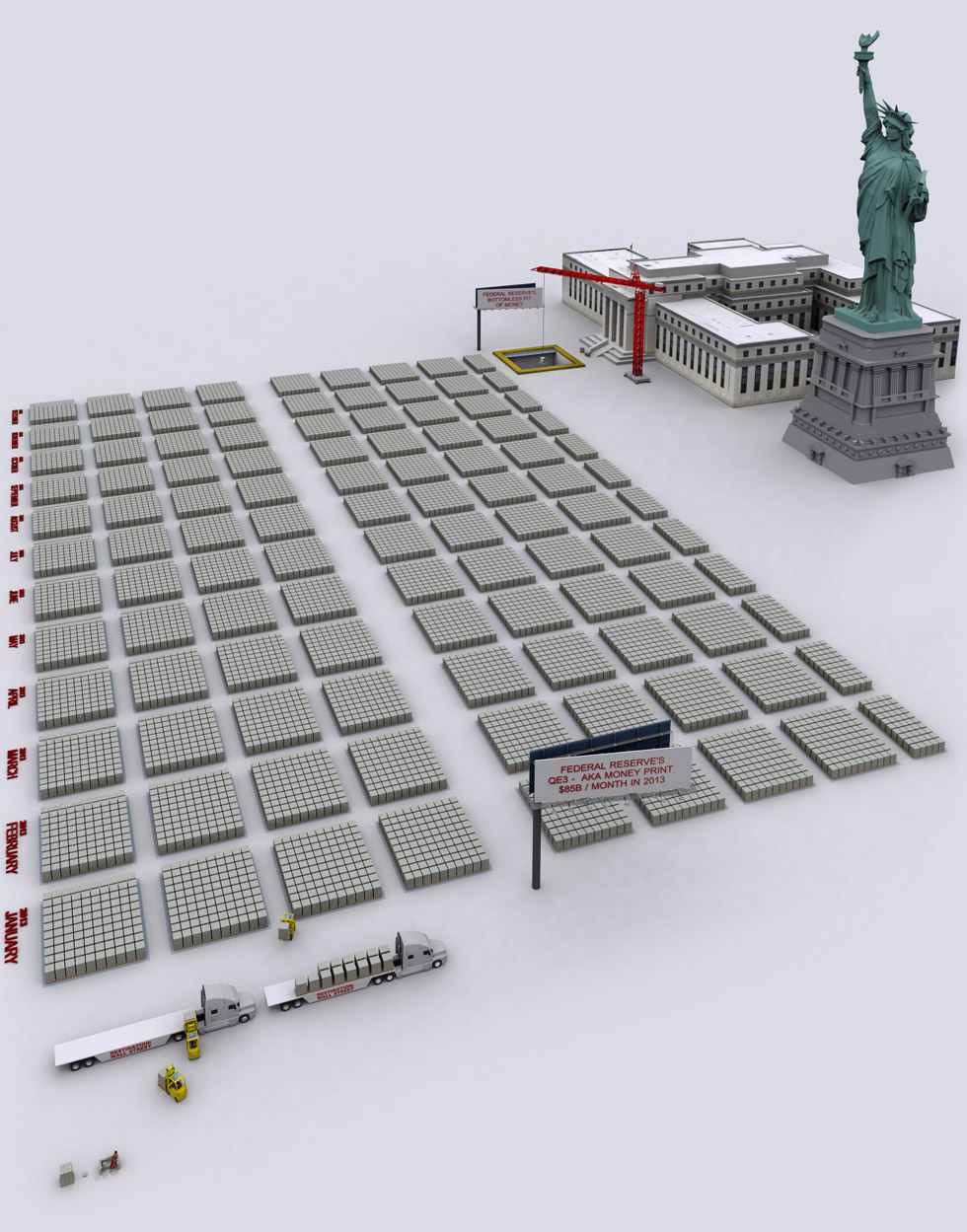

$85 billion / month is a big stack of bills:

Insolvency and bankruptcy.