Gab@StFerdinandIII - https://unstabbinated.substack.com/

Plenty of cults exist - every cult has its 'religious dogma', its idols, its 'prophets', its 'science', its 'proof' and its intolerant liturgy of demands. Cults everywhere: Corona, 'The Science' or Scientism, Islam, the State, the cult of Gender Fascism, Marxism, Darwin and Evolution, Globaloneywarming, Changing Climate, Abortion...

Tempus Fugit Memento Mori - Time Flies Remember Death

The fraud of the stock markets. The Cult of Keynes.

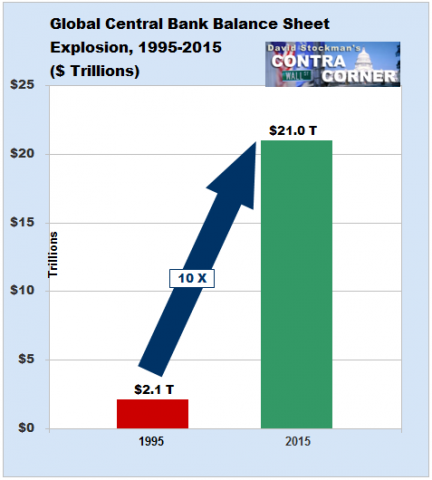

Bubble economics. Zero interest rates, endless money printing and distortions in capital, have created in most countries an incredible bubble in real estate and stocks. Central Banks – Keynesians to the man and woman – believe they are gods, that they can control manipulate, deceive and lie. Of course these Mandarins make cycles worse, they enrich their friends in the investment banks [and themselves]; they cause a cycle of busts that targets the average investor; they make fixed income savings a dream of the past; and they create enormous debts and leverage that can never be paid back or restituted, but simply defaulted on.

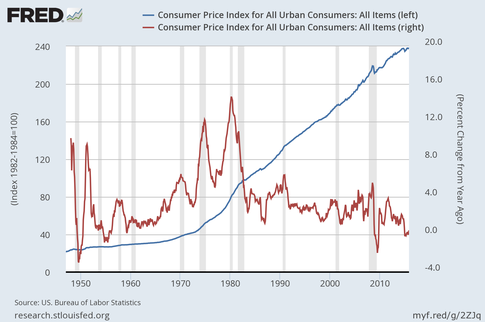

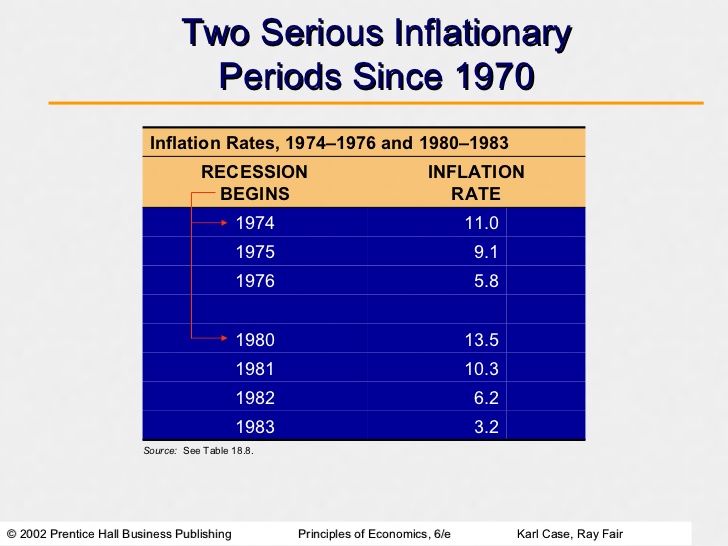

To justify their actions the Central Keynesian-Monetarist Bankers make up data [GDP, unemployment, inflation]. A personal favorite is of course 'Inflation' which is always zero. The answer is 0 - the methods to arrive at zero can change. Central Banks have changed the calculations. Using 1980s or 90s inflation metrics yields an inflation rate 2x what the Central Keynesians report today [about 3-4% p.a. vs. less than 2%]. Inflation calculations are for example a joke. It excludes 2/3 of the family budget and money creation. Money creation in the US alone last year was close to 5%.

How can you devalue the currency and have no inflation? No food, energy, taxes or other items which 'fluctuate' are allowed in inflation calcs. Therefore Central Bank inflation numbers measure precisely nothing. In most countries currencies have been mauled, their value erased, yet the peasants are told there is no inflation – even as food, energy, housing and other costs go up year after year by 5%, 10%, or in the case of some food items and utilities, 30%. Yet inflation is near zero ?

Inflation is the key metric to keep the fraud going. Even if oil prices have collapsed, currency values have likewise been annihilated. Any person living in reality knows there is inflation – probably 5-8% p.a. depending on where you live. But that would not allow the Central Keynesians to keep rates at zero or negative, and keep the stock markets primed and bubbled. After all, in the US and elsewhere, it is an election year [pick your year] and the 'right' Keynesian cult party must win.

Collapsing stock markets are notoriously bad for politicians. Real world inflation and fiat currencies in decline, are a good reason to hold some physical gold and silver - no matter what the 'experts' say.

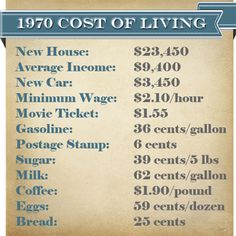

Central Bank fraud. There is no inflation. There is nothing bad about endlessly increasing the money supply. More money in circulation has no impact on inflation. There is no need to save money. Just invest in housing and stocks. Inflation is precisely '1.9 %', or whatever the fraudulent number is today. Since 1971 and the end of the Gold standard, prices, debt, money printing have gone straight up. A dollar in 2015 was worth maybe 15 cents of a 1971 dollar. Utilities across the world, along with many food items, not to mention housing are up 10% p.a. Money supply far outpacing its circulation has eroded and exploded many national currencies. But of course according to the great gods of Central Banks; there is no inflation.

Only Polly and Anna, and the frauds on CNBC and in the business media, so busy pumping their stock trivia, believe that stocks when normalized for zero rates, possessing a price-earnings multiple of 25-30x are fairly valued. Take away 0 rates of interest, admit that real-world inflation is 5%, arrest the printing of money and the attendant currency devaluation; and stop spending money [deficits] you don't have, and see what happens. A stock market fall ? Or maybe a crash?

“The so-called CAPE ratio—the price-earnings multiple for the market based on cyclically adjusted earnings averaged over the past 10 years—stands at over 25, well above its long-run average of about 15. Today's CAPE has been exceeded only during the market peaks of 1929, early 2000 and 2007.The CAPE does a reasonably good job of predicting 10-year equity returns. High CAPEs predict low future returns.” Source

When the next crisis shows itself – and it will at some point – hopefully there will be a hue and cry to jail central bankers for their Keynesian [monetarist] fraud; abolish central banks and go back to the gold standard which is the only [imperfect] method of ensuring that the plutocracy does not destroy your currency value. Today a 1971 dollar is now worth only 16 cents – but remember the elite's propaganda – there is no inflation.