Gab@StFerdinandIII - https://unstabbinated.substack.com/

Plenty of cults exist - every cult has its 'religious dogma', its idols, its 'prophets', its 'science', its 'proof' and its intolerant liturgy of demands. Cults everywhere: Corona, 'The Science' or Scientism, Islam, the State, the cult of Gender Fascism, Marxism, Darwin and Evolution, Globaloneywarming, Changing Climate, Abortion...

Tempus Fugit Memento Mori - Time Flies Remember Death

One of the important lessons of Friedman's monetarist theory is the non-economic observation he made about central banks. Friedman was convinced that central banks over time become politicized and that the leaders of the central bank – their personalities, psychologies, pathologies – massively impact monetary policy including the setting of rates and the printing of money. He was right. Friedman's analysis and those of the Austrian economic school make one empirically valid and crucial point – central banks destroy monetary value, they do not protect it.

When Bernanke or any central bank Chairman tells the media that the current economic crisis, which was caused by government and political interference in the housing market stretching back 50 years; and which was abetted and accelerated by grotesquely incompetent and easy monetary policy during the Bush administration; was in actual fact not caused by too much money, low interest rates and political meddling in housing finance, one can assume he is either a liar, a political puppet, or stupid. Since Bernanke is obviously not dumb, the first two options must apply. The US central bank formed in 1913 and the 4th in US history, long ago ceased being independent and has been for some time, simply a tool of the Treasury department, or in other words, the puppet-monetary division of big government.

Friedman's monetarist theories have much to commend them. He proved that government caused the Great Depression, turning what should have been a necessary and sharp recession into an economic disaster. Personalities played a huge role in the fiasco of the 1930s. When Strong the realist Fed Reserve chairman died in 1928, his successors had no experience and no conceptions on how to deal with recessions. All of their policy choices reflected their bias to maintaining the US dollar-Gold standard relationship by reducing money supply and raising rates to attract capital – the opposite of what should have been done [and probably enacted at the behest of the politicians who for many reasons wanted to remain on the Gold standard]. The administrations of Hoover and FDR – socialist, statist and enamoured with central planning – raised tariffs, taxes, regulations and fiscal spending to absurd levels. In combination with poor monetary policy, statism assured that a Depression would begin.

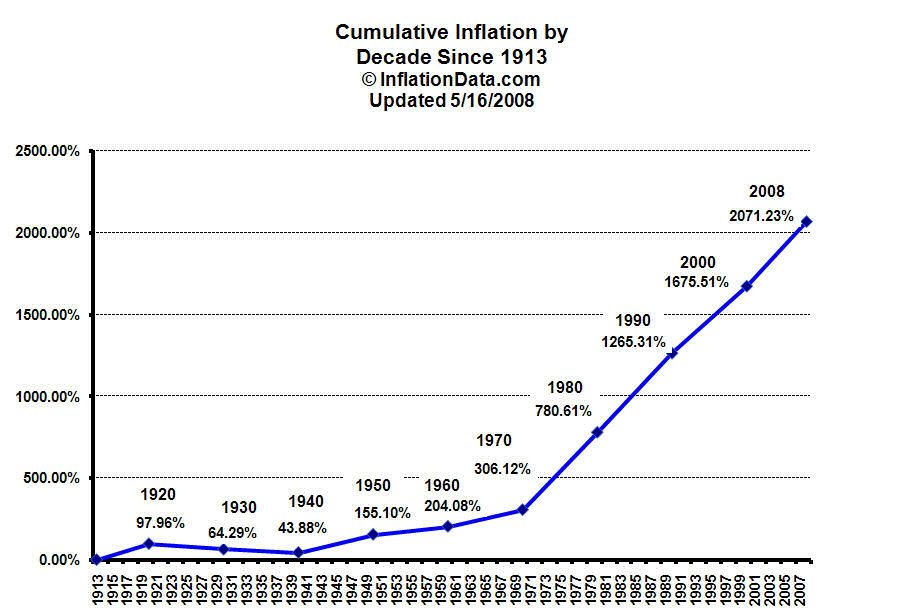

It is a well worn fact that since 1914 the US dollar has lost 95 % of its value. Most of this has occurred in the years since 1945, and the implementation of runway monetary growth and fiscal Keynesianism. In the 70 odd years before 1913, when the US did not have a central bank, the US dollar maintained its value. In fact the average real inflation rate of money growth during the life-spans of all 4 US central banks has been 11-14% per annum! This growth in money supply [M1, M2 and M3 which is now no longer reported by the government], which is far in excess of real GDP growth net of inflation, population and household growth is simply immoral. It accounts for the destruction of US dollar value from 1913 to 2010. Yet the pious Fed Reserve charter lists controlling inflation and maintaining the stability of the US dollar as its key prerogatives, along with, rather bizarrely, creating full employment.

It is clear that the US central bank – like all central banks – has not protected the value of its national currency. It is also obvious that no central bank can possibly have 'full employment' as a mandate. Central banks do not operate or control the economy, they do not create jobs or stimulate investment, they do not allow for the manufacture of profits or new markets. The only role a central bank has is in controlling the money supply to reduce inflationary pressures and setting interest rates at levels to depress any inflationary trends in the economy. That is it. The creation of employment is entirely a supply side, market based set of initiatives, and policies resting in an optimistic, rational and legal political-economic framework.

Central banks have thus undermined not only the living standards of their populations, but also the very functioning of the economy. By promoting inflation, and bubbles, central banks have destroyed trillions in wealth. Central bank created bubbles in the past 20 years include the Savings and Loan banking disaster in the southern US during the 1980s; the internet bubble, and of course the recent housing finance catastrophe. The central bank was not the only actor involved in these 3 bubbles – but it was a vital player. Its independence has long been forsaken. We now have the central bank as the lackey of government with monetary policy supporting fiscal Keynesianism and endless government spending.

As Judy Shelton wrote in WSJ, the real inflation rate in the economy, makes a mockery of the Fed Reserve's claims that it protects the US dollar:

"According to U.S. Census Bureau statistics, the average sales price of a new home in 2000 was $207,000; the average price in 2007 was $313,600, more than 50% higher in just seven years. During the same period, based on Consumer Price Index (CPI) numbers for the interim years provided by the Bureau of Labor Statistics, the average sales price of a new home should have been $250,625 in 2007—that is, if the CPI fully captured the impact of excessive monetary issuance."

http://online.wsj.com/article/SB10001424052748704842604574642153438387892.html

In this simple example the increase in money and liquidity, combined with real negative interest rates, induced people to use leverage to buy or upgrade homes. This increase in money supply thus increased the demand for housing and house upgrades. Prices naturally rose. But at some level the amount of debt, the size of the house, or the cost of the upgrade will arrest the price appreciation. This is especially true as interest rates rise. Once rates go up the demand for housing investment must fall. It is at this point when demand is completely satiated and can rise no further, and when the costs of leverage become too onerous, that prices will go into a large decline.

All of this was created by politicians, their housing finance scams and programs, and of course central bank monetary policy. There never was a US market in housing or home finance. It was a government created distortion.

Look at it another way as given by Shelton's analysis. If you normalize real inflation into the lie and scam called 'the GDP rate of growth', you will find that the US economy has not grown at all during the past 10 years. The only thing which has grown is big government under the Bush-Bama regency, and the increase in the dollar's value decline. The average US taxpayer should be furious about the destruction not only of their wealth; but the distortive and quite nefarious impacts of bubbles on the economy and personal lives. It is simply a travesty.

This destruction of the US dollar's buying capability is of course reflected in the price of Gold – another statistic that printing-mad big Ben Bernanke fails to acknowledge:

"And what about gold? The price of gold has soared to $1,128 today from $282 at the beginning of the decade, a fourfold increase. During the critical 2002-2006 period—when Mr. Bernanke insists monetary policy was consistent with the Fed's price-stability goals—the dollar price of gold climbed steadily to $700 from below $300. Did the governors of our nation's central bank not notice? Given that the U.S. government holds the largest amount of official gold reserves in the world, it would seem pertinent."

The real world black and white facts are this. Gold has doubled in 10 years. The US dollar has fallen 35% in 10 years. Two enormous bubbles have been created in the same 10 years. Trillions of aggregate wealth has been vaporized. Yet the US central bank calmly maintains that it is doing a great job. Even today it is following the bubble prescription; zero interest rates; money supply growth of 10% per annum; and guarantees to banks. So when will the next bubble occur and how ugly will it be ?

In the real world outside of theory there is one sure iron law of economics. Once the central bank becomes a political tool; and once the central bank engages in statist economic management, the destruction of wealth, jobs and economic progression is assured. The US Fed Reserve has been distorting the US economy since 1913. Well done.