Gab@StFerdinandIII - https://unstabbinated.substack.com/

Plenty of cults exist - every cult has its 'religious dogma', its idols, its 'prophets', its 'science', its 'proof' and its intolerant liturgy of demands. Cults everywhere: Corona, 'The Science' or Scientism, Islam, the State, the cult of Gender Fascism, Marxism, Darwin and Evolution, Globaloneywarming, Changing Climate, Abortion...

Tempus Fugit Memento Mori - Time Flies Remember Death

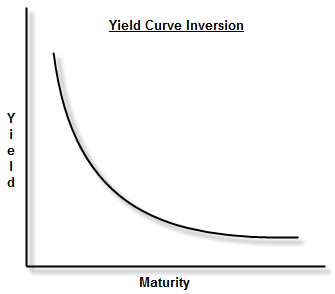

Yield curves are the best predictors of recessions and depressions. Negative yield curves have predicted every recession for the past 150 years. A negative yield curve is when long-term interest rates are lower than short-term rates. This indicates a level of pessimism about the future which is hard to ignore. Typically in a healthy economy the longer the term of investment, the higher the rates demanded or expected due to uncertainty and risk. When the opposite occurs, trouble has to be ahead. When investors believe that the near-to-long term future looks so unsettled and bleak that they would rather discount future rates below current rates, than something in the political-economy is deranged. As a recent Forbes article commented:

“One of our favorite market and economic indicators concerns interest rates, particularly the difference between long term rates and short term rates. Normally, bonds pay investors a higher yield for committing their funds over a longer maturity. Short-term loans (bonds) generally pay less than long term bonds because you have less risk.

With a short term three- month treasury bill or CD, an investor doesn't have to wait very long to get their principal back. The interest rate difference between long term bonds and short term treasuries is known as the yield spread.

......Every so often a normal yield curve get distorted and inverts. It makes no sense when short term interest rates pay investors more than long-term bonds, so when it happens, we can assume that something unusual is about to occur. Inverted or negative yield curve spreads have been excellent predictors of recessions for many years.”

The negativity is justified. The welfare state, along with the attendant mental distortions of cultural Marxism, statism, and the expectation that unfettered government spending, planning regulating and 'security' is 'moral', all lead to some obvious conclusions about the future. Socialism, and Fascist governance always lead to bankruptcy in matters financial, cultural, moral and educational. There is not one single Western state which is not officially bankrupt. Most states have 5-10 times the value of their Gross Economic output, in debt. This level of debt is the greatest accumulation of credit in history. Future growth in the face of higher taxes; Mother Earth fees; carbon taxes; and more governmental distortions is nigh impossible, as the WSJ reported:

"The flattening has reflected increased anxiety that the global economy could relapse," said Ward McCarthy, chief financial economist in the fixed-income group at Jefferies & Co. "This will exacerbate the Federal Reserve's concerns about disinflation evolving into deflation."

Jeff Michaels, co-head of fixed income at Nomura Securities International in New York, noted that the move in the yield curve also suggests "all the regulation and the fiscal-authority measures globally are going to crimp any moderate growth we would have had."

As Fernand Braudel wrote in his opus on Capitalism, no state which surpassed the threshold of 200% long survived. Flattening and negative yield curves support this thesis. One time powers such as Venice or Spain suffered the predictions of negative yield curves in the early modern period by going bankrupt – thanks to statism and governmental despotism. Mexico Russia, Argentina and South Asian states went through similar cycles and all ended up declaring bankruptcy in the 1990s. Ohio and Illinois went out of business in the 1840s due to rampant governmentalism and poor financial control. Britain, thanks to the inglorious accumulations of debt from the welfare state disease post 1945, became by 1960 just another has-been world power mired in Marxist madness. Today the EU is drowning in debt with real liabilities some 8-10 times the size of the EU economy or $125 Trillion in total. It is no better in the US or Canada.

Madness all of it. Greece is not alone in its frenetic rush to insolvency. Every single Western state is engaged in the same set of policies which will turn them all into Grecian clones.

But little of that reality seems to make a real impact on the political-economy of Western states. A recent Le Monde article for instance praised the Greek government for clarity, courage and doing what needs to be done. This is laughable. Grecian budget cuts amount to 2 % of the total budget. Unions will still run the country tomorrow, next year, and 5 years from now. Over half of Greeks work for the government. Most Greeks work less than 25 total years. This won't change. Lollipops, candy, and rhetoric for the children. No politician is going to risk a $150.000 a year job; with a $100.000 a year pension for life, not to mention the office, the cherry wood furniture, the marble floors, the status, the women, and the various second and third homes obtained through corruption – to salvage an insolvent state. Why would they? They don't care. Le Monde states that even if Greece can reorganize its finances it will most likely need to restructure its overall debt. This is French meaning 'to default'. The possibility of Greece going bankrupt is real indeed:

Même si la Grèce met en oeuvre jusque dans ses derniers détails son plan de redressement économique, il lui sera peut-être difficile d'éviter une restructuration de sa dette publique, qui devrait atteindre près de 150 % du PIB en 2016. Il en coûte toujours au pays 8 % de plus qu'à l'Allemagne pour s'endetter à dix ans, ce qui montre le scepticisme persistant des marchés.

Those are the facts. Interest rates on new Greek debt are above 8% and interest payments alone cannot be met by fiscal cuts of 2-5% to the budget; nor by increasing taxes. When you can't make your interest payments the game is over. Le Monde says that total Grecian debt is 150 % of PIB or GNP. This is a lie. You need to add in all the off-the-balance programs not included in the 'official numbers', including pensions, socialized health care, day-care, dental-care, and welfare guarantees for the next 20 years. This socialist contract with the children and wards of the welfare state is real enough. Future obligations dwarf the official statistics on debt in every single Western state. Greece is just a foretaste. The destruction of Western political-economy will only get worse as the desperate little minds of the socialists and globalists concoct Mother Earth taxes; carbon taxes; bank taxes and children's future taxes to solution deficits and mounting debts, further destroying growth, jobs, innovation and wealth.

And so the death spiral will accelerate.

Like all Western states the true Grecian debt is thus probably 800 % of GDP. The Greek problem is that a large part of the 'official' debt, about 25% of the $400 billion total debt, needs to be rolled-over, or renewed in the next year. Other bankrupted Western states don't have this level of renewable debt coming due. But they will. Within the next 5 years, most Western states will see an accelerating level of short term debt come due to be 'rolled over'. When that happens expect the situation in the US, the UK, France and Germany, to be similar to that of Greece today.

Negative yield curves are thus vital to ascertain what the holders of capital are thinking. No one who owns capital is fooled by governmental and statist rhetoric. No one who analyzes Greece is comforted by the notion that those courageous Greeks will cut their welfare state spending by a massive 2 % and save their state. Few who regard the accumulation of debt under the Black Jesus Obamed, some $5 Trillion in just 18 months, believe that the US can long avoid debt restructuring, higher taxes, and social unrest. US bankruptcy is a real possibility. Not many truly believe that the Euro will survive as the currency of a bloc of states which disregard fiscal, and political-economic reality. That is why the yield curve is negative. The realists are casting their votes. And it is a vote against the unfettered expansion of Marxism and Socialism.