Gab@StFerdinandIII - https://unstabbinated.substack.com/

Plenty of cults exist - every cult has its 'religious dogma', its idols, its 'prophets', its 'science', its 'proof' and its intolerant liturgy of demands. Cults everywhere: Corona, 'The Science' or Scientism, Islam, the State, the cult of Gender Fascism, Marxism, Darwin and Evolution, Globaloneywarming, Changing Climate, Abortion...

Tempus Fugit Memento Mori - Time Flies Remember Death

The cult of government. Government is your 'friend'. Government loves you. Government is the innocuous 'G' in Keynesian non-science. Government is moral, happy, delighted to aid you. Government only desires the best for the children's future. Government loves Gaia. Government 'built that', and only Government can 'create', 'innovate' and inspire. Rubbish the lot of it, but the general zeitgeist is that the benefices of government know no limits.

This cult applies itself to markets of all stripes and variety. There is nothing that government does not desire to control, regulate, tax, tax again, tax a third or seventh time, and manage. The US for example, is not the home of the brave, market-loving cowboy; but now resembles the home of the over-taxed, uber-regulated child in 6th grade, terrified of falling off the monkey-bars at recess or scratching a knee while playing tag.

In reality government is of course the problem. Governments and their lackeys called 'central banks' create bubbles. Tyrannical, absurd, expansive, corrupt, negligent, cowardly, ignorant of culture and civilization; it has been government and its cults which sell communism, marxism, multiculturalism, easy money, 'quantitative easing', housing 'insurance', and the bailouts of too-big-to-fail firms. Various other 'scientific isms' are paraded daily by government knaves in the mass-media as 'iron laws' of rationality and morality. So much for the dark ages.

Nicholas Pardini, in his 'Pardini Report' gets the facts straight about our current government initiated 'bubble': Detailed Case to short the S&P 500, this time is not different.

Pardini stipulates the following, none of which can really be disputed

-the US [and European] middle class is disappearing

-incomes are stagnant and personal debt is growing

-higher interest rates are a certainty given that the US central bank must eventually exit is current easy money and bond-buying programs

-stock market [and housing bubbles] as in times past, will pop

Pardini: When everyone is a 'bull', something is wrong

Bullish sentiment is nearly unanimous amongst both retail investors and investment professionals. Margin debt on stock purchases is at all-time highs, 75% of newsletters are bullish, the average hedge fund is leveraged long, and bullish option speculation is at all-time highs. This indicates that all the money is on one side of the market. Since economic fundamentals do not confirm such market euphoria, this is a strong contrarian sell signal.

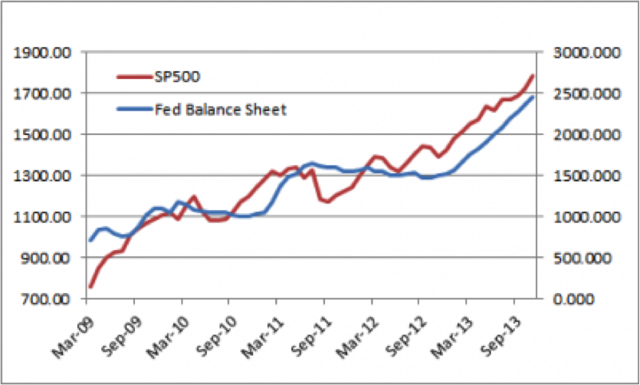

Pardini: The stock market rise is a perfect match to the Fed's expanding balance sheet

Pardini: Stock valuations are near record highs [contrary to media reporting]

“...valuations for US stocks have reached rich levels only seen in 1929 and the late 90's tech bubble. The P/E ratio of the S&P 500 is currently at 19.55, which is 30% above its historical average. As seen in the chart below, valuations adjusted for changes in the business cycle (Shiller P/E) are at highs only previously seen in 1929 and the tech bubble.”

Pardini: The real economy [not the media-reported economy] is very weak

“The real economy is not growing, real living standards amongst 90% of Americans are declining, and this slowdown is reflected in poor earnings. The catalysts for this bull run of easy money and institutional corruption causing multiple expansion is shaky at best. Technical indicators also are overbought, and sentiment is over bullish. With our 2014 price target for the S&P 500 below 1600, our outlook is negative for most developed market stocks. The crash of 2014-2015 will be brutal and come to surprise most market experts despite the signs being obvious for anyone looking at fundamentals beyond FOMC guidance.”

Pardini: Any exit program initiated by the Fed will mean higher rates which pops the bubbles

“Interest rates will rise in either scenario. The combination of increased inflation expectations, higher sovereign default risk, or tightening policy will be the catalyst. Not all of these will happen, but the probability of at least one happening is near certain. Higher rates makes stocks less attractive versus bonds, increases the financing costs of traders on margin or highly levered companies, lower housing prices, and also will trigger more consumer defaults.”

Pardini: Most of us are still broke and there is no easy solution to remedy this

“The bottom line is that the American consumer is broke and has no disposable income. Without disposable income to spend or save, there is limited capacity for real private sector growth and therefore the US economy continues to stagnate even with sustained cheap credit. The only solution to this problem is to either allow a major deflationary bust to lower the prices of basic goods such as housing, energy, and government spending to more "affordable" levels for current wage levels (which may include a haircut in US treasuries) or allow real standards of living to fall stealthily through inflation.”

The media and the business 'channels' posit the opposite of the above. To the big-brains propaganda machine of government, all is fine, fundamentals are strong; there are no bubbles; the consumer is 'robust' as are corporate earnings; and government policies are wonderful.

When such sentiments are expressed as 'facts' you know that the contrary is true.